Sandra Kraus new Leasing Director at CTP

Jan 28, 2026 at 2:10 PM

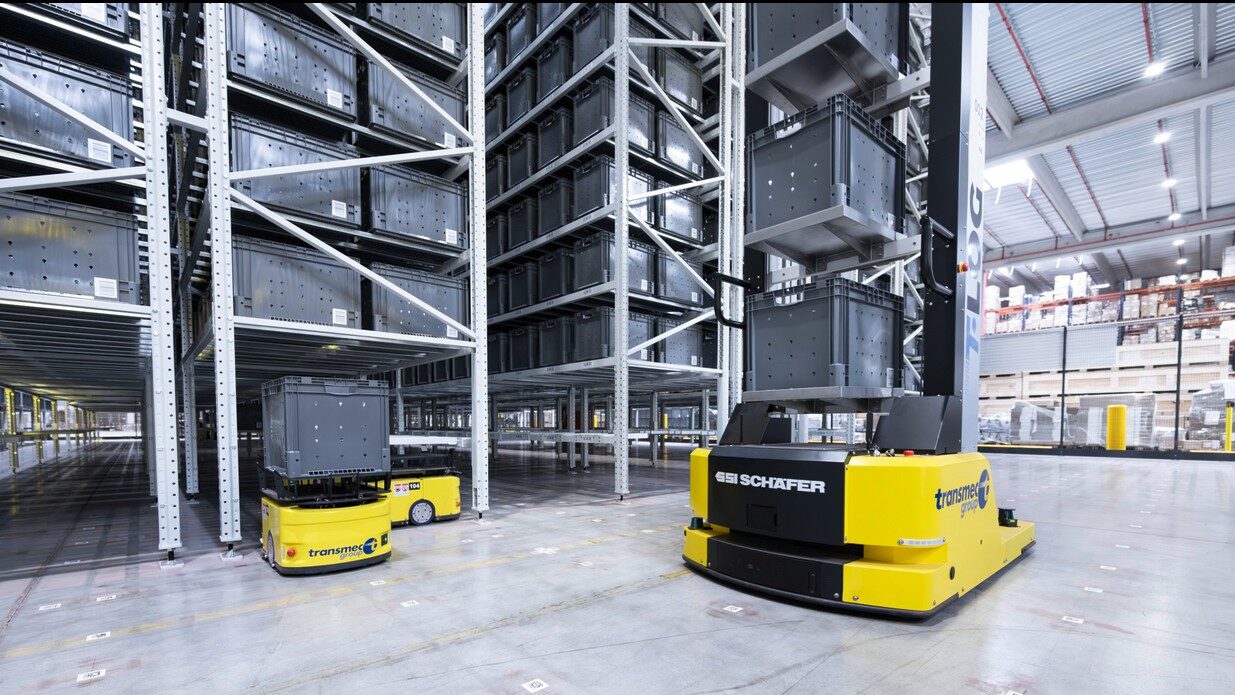

SSI Schäfer plans logistics center for Rossmann Czech Republic

Jan 28, 2026 at 2:27 PMThe credit reporting agency Creditreform has issued a credit certificate to the logistics company Gebrüder Weiss, confirming the company’s high financial stability. According to Creditreform, Gebrüder Weiss has a strong and stable financial foundation, reflected in a credit index of 173 points. This value is above the industry average and is an indicator of the financial solidity that can only be achieved by particularly financially strong companies in Austria. Wolfram Senger-Weiss, Chairman of the Management Board of Gebrüder Weiss, received the certificate on January 20, 2026, at the company headquarters in Lauterach, Vorarlberg.

Credit Index as a Measure of Economic Reliability

The credit index serves as a measure of a company’s economic reliability and indicates how well it meets its financial obligations. The rating scale ranges from 100 points, indicating very high creditworthiness, to 600 points, representing a high risk. A lower value means a better rating.

The analysis leading to the determination of the credit index considers various factors, including economic development, equity, and the company’s payment behavior. Structural aspects such as company size, industry, and long-term stability also contribute to the assessment. In recent years, Gebrüder Weiss has already achieved comparably high credit ratings, indicating continuous and stable corporate management.

Trust in Economically Challenging Times

Wolfram Senger-Weiss commented on the importance of financial stability: “Financial stability creates trust—especially in economically difficult times with high inflation and weak global trade. The assessment by Creditreform confirms Gebrüder Weiss’s solid financial foundation and long-term orientation. This provides our customers, partners, and employees with security in collaboration.”

Creditreform is one of the leading credit reporting agencies in the German-speaking region and assesses the creditworthiness of companies based on objective, continuously updated data.